Tax Saving Tips for Investors and Business Owners

Taxes are one of our biggest lifetime expenses. They impact our cash flow, investments, properties, and businesses…not to mention our overall net worth. While they may spark *dread* instead of joy, they still deserve our time and attention—because understanding different strategies to lower your annual tax bill can really add up over time.

When it comes to feeling confident in your overall financial strategy, knowing the basics of how taxes work and how taxes impact your income is key.

How Do Taxes Work in the United States?

The amount of tax you owe is based on how much your taxable income (how much you earn) and your filing status (single, married filing jointly, married filing separately, etc.).

You’re expected to pay taxes throughout the year, either through withholding from your paycheck or through quarterly estimated tax payments (for business owners).

The United States uses a progressive tax system, which means your tax rate goes up as your income goes up—income tax rates range from 10% to 35% tax brackets.

You can visualize the way taxes are paid as a staircase—with portions of your income being taxed at different rates as you climb each step.

Let’s say you earn $500K of income in one year—this would put you in the top marginal tax rate of 35%. The good news? This doesn’t mean you will pay 35% on all of your $500K...instead, you’ll pay:

10% on the first $10K you make

12% on the amount between $10K and $40K

22% on the amount bw $40K and $85K

24% on the amount bw $85K and $165K

32% on the amount between $165K and $210K

And 35% on the amount between $210K and $525K

In this example, your effective tax rate is 32.66% if filing as single. You can use online Federal Income Tax Calculators like this one to personalize what your effective tax rate is!

What types of income are taxed?

Earned Income and Unearned Income

Income can be divided into two main categories: earned and unearned.

Earned income is anything you make by working for an employer, a business, or yourself. Most people fall into this category. Some examples are:

Hourly wages or salary

Business income

Income earned from self-employment

Unemployment benefits

Sick pay

Some disability benefits

Pensions

Unearned income comes from interest, dividends, royalties, virtual currencies, and profits from the sale of assets.

You can think of unearned income as anything that you didn’t have to trade your time working for. This doesn't include gifts or inheritances, at least not at the federal level.

How do taxes impact your stock market investments?

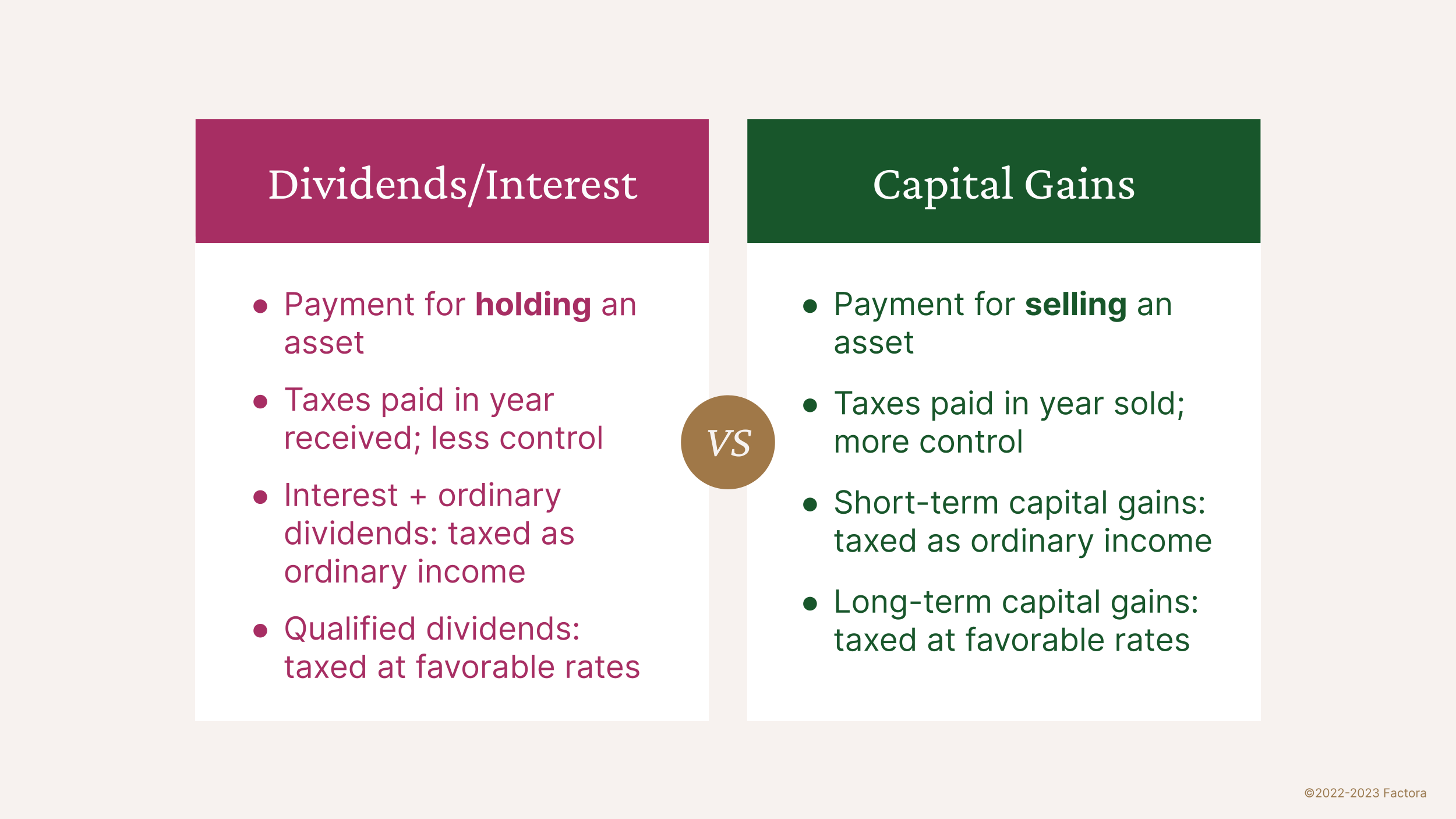

The two main kinds of stock market investment taxes to be aware of are those that you pay on dividends and interest earned and those that you pay on capital gains.

You earn capital gains when you sell an asset for a profit.

Example: If you bought a stock for $100 and sold it for $500, you’ve earned a profit of $400 and will be taxed on that amount in the year that you sold the stock.

Short-term capital gains are profits made from selling assets held for a year or less; generally taxed at the same rate as your ordinary income.

Long-term capital gains are profits made from selling assets held for longer than a year. These are generally taxed at lower rates than short-term capital gains, meaning it’s typically beneficial to hold investments for more than a year.

You only owe taxes the year that you sell your asset, not every year that you hold it. This gives you more control over when you owe taxes because you can decide the best time to sell based on your financial situation and goals.

Dividends and interest are earned from assets that you hold within your financial portfolio.

Dividends are regular profit-sharing payments made between a company and its investors. These types of payments are considered income, so you pay taxes on them in the year they are received.

Interest and ordinary dividends are taxed at your regular income tax rates. Whereas qualified dividends are taxed more favorably at long-term capital gains rates. Qualified dividends are those that meet specific criteria (paid by a US company or qualifying foreign company & holding period has been met).

Dividends and interest are always taxed the year that you earn them.

What about taxable vs. tax-advantaged investment accounts?

Another factor that impacts the taxes you pay on stock market investments is whether you’re using taxable or tax-advantaged accounts to invest.

Check out the chart below for a quick overview or this blog post for more detail on tax-advantaged accounts.

How do taxes impact your real estate investments?

If you own a rental property, any net income your rental property generates (the amount you make after deducting expenses) is taxable as ordinary income on your tax return.

Some tax deductions include:

Property depreciation

Related rental property expenses like

Utilities

Cleaning fees

Management fees

Mileage to and from your property

Travel if buying a new property a market that you need to fly to

How do taxes impact your business income?

If you have a business, freelance work or side hustle here are three things to consider when planning for taxes:

Decide whether you're setting up a Sole Proprietorship or an LLC: These are taxed the same, but LLCs protect you from being sued by a client. Make sure to do your research or consult an attorney to decide what makes the most sense for you and your business)

Separate your business and personal finances: Open up separate accounts to keep income and expenses separate. This is key and will make filing taxes so much easier!

Keep up with your business bookkeeping: 93% of business owners overpay on taxes because of missed documentation. Doing bookkeeping on a monthly basis helps you stay organized and not miss any expenses or income come tax time.

Deductions to consider as a business owner:

Home office expense

Travel - airfare and hotels

Auto

Meals